China’s Textile Exports Hold Strong in 2025 While Import Declines Indicating Self-Reliance

December 24, 2025 | Apparel Industry

As global markets continue to shift, China’s textile and apparel industry is navigating a year of contrasts. While textile yarn and fabric exports show steady resilience, apparel exports are feeling the pressure — pushing the industry toward a much-needed transformation.

Here’s what the latest data tells us, and why it matters for brands, manufacturers, and innovators shaping the future of fashion.

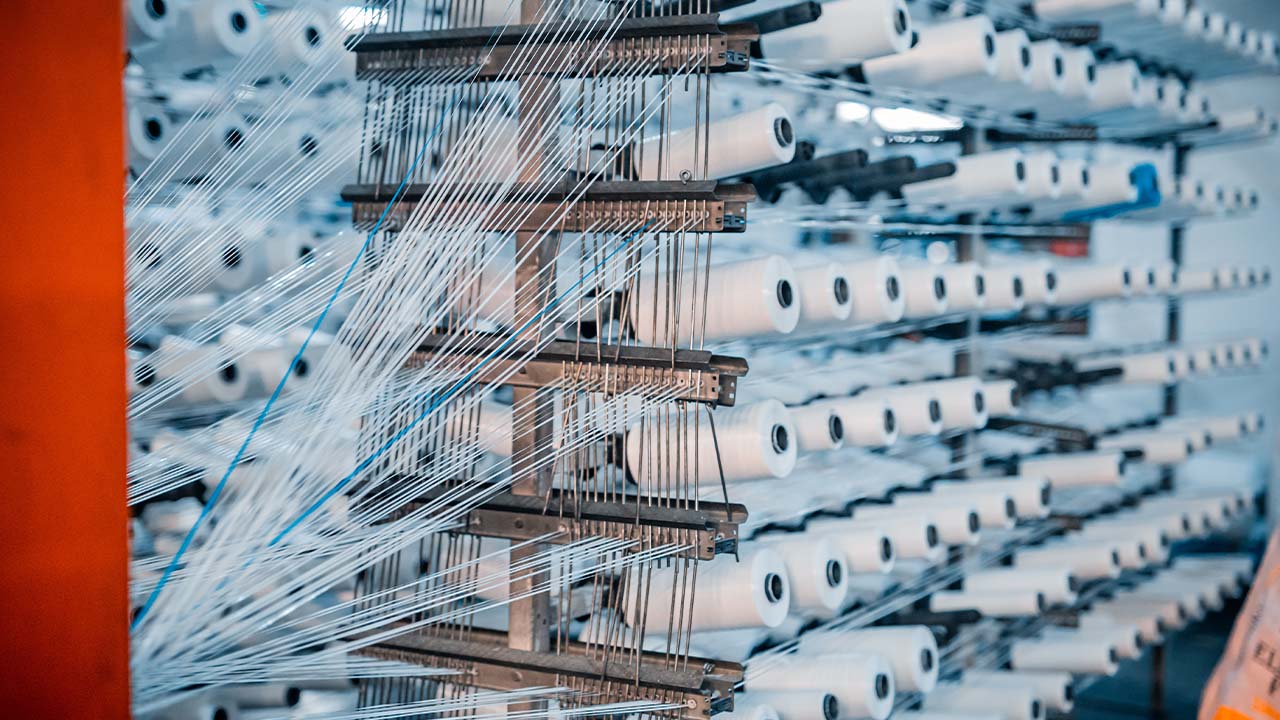

China’s Textile Exports Stabilizes

China’s textile sector continues to demonstrate its production depth and global relevance.

According to customs data, exports of textile yarns, fabrics, and related products reached US$12.27 billion in November 2025 alone. From January to November, cumulative exports totaled US$130.01 billion, marking a 0.9% year-on-year increase compared to 2024.

This steady growth isn’t accidental. It’s supported by:

- A stable upstream raw material supply

- Mature spinning and weaving capabilities

- Continued overseas demand for high-quality textile products

Together, these factors reinforce China’s role as a reliable backbone of the global textile supply chain — even amid economic uncertainty.

China’s Textile Imports Decline Indicateding Self-Reliance

While exports remain solid, textile imports tell a different story. Between January and November 2025, textile yarn and fabric imports fell to US$8.98 billion, down 8.9% year-on-year. November imports alone stood at US$900 million.

This decline reflects two major trends:

- Shifts in the global raw material supply landscape

- Stronger domestic substitution, as local production increasingly meets demand once fulfilled by imports

Looking ahead, fluctuations in international raw material markets will remain a key variable — but China’s growing self-sufficiency is clearly reshaping sourcing strategies.

China’s Apparel Exports Under Pressure — But Not Without Opportunity

The apparel segment faces a tougher reality. In November 2025, exports of clothing and accessories reached US$11.59 billion. From January to November, total exports fell to US$137.79 billion, a 4.4% decline compared to the same period in 2024.

Behind this slowdown are familiar challenges:

- Volatile global consumer demand

- Intensifying competition in emerging markets

- Changing consumer preferences

- Trade barriers compressing margins

But pressure often sparks progress.

Transformation in China’s Apparel Sector is no Longer Optional

To stay competitive, apparel exporters are actively reinventing themselves. Across the industry, we’re seeing a clear shift toward:

- Design-driven differentiation

- Products infused with fashion, culture, and identity

- Digital marketing and cross-border e-commerce to reach global consumers directly

The integration of manufacturing, branding & design is emerging as a decisive growth strategy. Those who embrace this evolution are better positioned to move beyond price competition and reclaim value.

Road Ahead

Taken together, the numbers reveal an industry at a crossroads. Textile yarn and fabric exports remain steady & resilient; apparel exports are under strain but rich with transformation potential and raw material imports are declining as domestic capabilities strengthen. The message is clear - data-driven strategy, innovation, and digital transformation will define the next phase of growth.

At Threadify, we believe the future of textile and apparel trade belongs to those who combine manufacturing excellence with smart technology, agile supply chains, and strong brand thinking. In a changing global landscape, adaptability isn’t just an advantage — it’s a necessity.

Empty Cart

Empty Cart