What an U.S. Imposed 100% Tariff on China Could Mean for the World’s Apparel Industry

October 11, 2025 | Apparel Industry

On October 10, 2025, US President Donald Trump announced that, effective November 1, the United States would impose a 100% tariff on China, on top of any existing duties. This sweeping escalation marks one of the most dramatic turns yet in the ongoing US–China trade war. For the global apparel and garment manufacturing industry, already fatigued by supply chain disruptions, rising costs, and shifting consumer demand, this move could be a watershed moment.

In this post, we’ll explore how this policy might ripple through sourcing, costs, competitiveness, and strategies across regions.

The US China Tariff War 2025: Tariffs, Trade, and Tensions

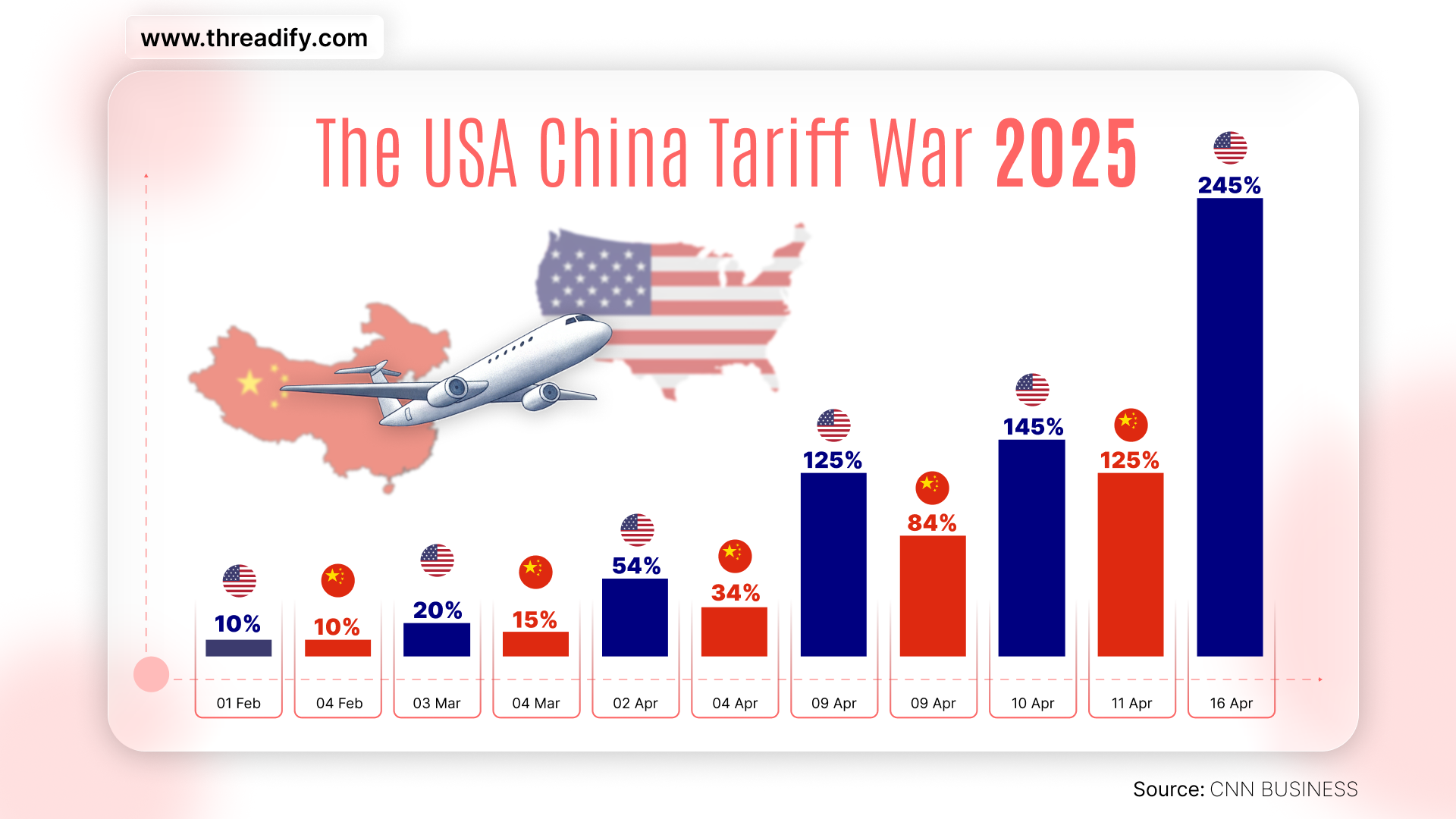

In 2025, the US–China trade standoff intensified:

Earlier this year, the US imposed broad “reciprocal” tariffs—including a baseline 10% duty on imports from many countries—with additional surcharges for nations with large US trade deficits. China, in parallel, introduced stringent export controls on critical goods and technology—controls that the US described as “hostile” and “extraordinary.”

The new 100% tariff is not a replacement—it is in addition to all existing tariffs. That means many Chinese goods will experience battery-stacked duty rates. China already has political, regulatory and retaliatory tools at its disposal—e.g. antitrust investigations, export controls, trade countermeasures. Thus, the current tariff move is part of an escalation spiral where trade, tech, geopolitics and industrial policy interplay.

How Will 100% Tariff on China Affect Apparel Industry?

Cost Inflation & Price Pressure

A 100% tariff is effectively a doubling of the input cost (for goods wholly from China). Even if brands or suppliers absorb some, substantial cost push-down is inevitable. Analysts already warn that items as basic as jeans, sneakers, and T-shirts may see steep price hikes.

Supply Chain Rerouting / Diversification

Brands will feel pressure to shift production away from China as swiftly as possible. Many have already been doing this (the “China plus one” strategy). The new tariff accelerates that. But challenges abound as alternative sourcing countries (Bangladesh, Vietnam, Cambodia, India, etc.) are themselves facing elevated US tariffs and supply bottlenecks.

Winners and Losers

Potential winners are garment hubs with slack capacity, favorable trade treaties, stable infrastructure, and cost competitiveness. These may capture displaced business. Whereas the potential losers are small-scale suppliers, countries without trade privileges, brands that are heavily China-dependent without flexibility, or those unable to absorb cost increases.

Large brands and vertically integrated firms could absorb or manage shocks better due to bargaining power and scale. Smaller brands and fast fashion players with thin margins might be squeezed.

Retail & Consumer Effects

- Consumers in the US are likely to bear much of the burden through cost passing. A “consumer tax” effect is expected.

- Demand elasticities — especially in mid-to-lower price tiers — may decline.

- Brands may re-think inventory strategies (more buffer, front-loading, nearshoring) but at the expense of capital and working capital risks.

- Some consumer groups may prefer brands “made closer to home” (reshoring / nearshoring) to avoid tariff penalties.

Risk, Uncertainty & Strategic Flexibility

- Trade policy is volatile—tariffs may be raised, lowered, or contested in courts.

- Legal challenges could emerge around executive authority to impose such sweeping tariffs.

- Geopolitical shifts (China’s retaliation, third country responses) may cascade.

- Currency fluctuation, shipping cost volatility, and logistic disruption add layers of risk.

- In such an environment, agility, flexibility, and resilience become critical competitive advantages.

What Industry Players Should Do?

Short Term Moves

- Map and stress-test supplier networks

- Front-load orders (if feasible) to pre-tariff window

- Re-negotiate terms: cost sharing, risk allocation with suppliers

- Hedge currency and secure logistics contracts

- Build buffer stock and route diversification

Mid / Long Term Strategy

- Invest in capacity in alternative sourcing countries

- Improve supplier development (skills, compliance, reliability)

- Automation, digitization, quality & value-add (to reduce dependency on low-cost labor)

- Regionalization / nearshoring (closer to consumer markets)

- Sustainability, differentiation, higher margin positioning

Policy & Collaboration

- Engage in trade advocacy, lobbying, industry bodies

- Seek tariff carve-outs, preferential trade agreements

- Monitor legal / regulatory developments closely

- Build Resilience & Flexibility

- Don’t put all eggs in one region

- Create visibility in supply chain (traceability, data)

- Scenario planning, risk contingencies

Final Thoughts & Takeaway

The imposition of a 100% US tariff on Chinese imports is not just another trade skirmish—it may fundamentally redraw the economics of global apparel sourcing. While it inflicts immediate cost pain, the longer-term shifts may favor suppliers and regions that can pivot fast, invest in capability, and offer agility. For apparel brands, manufacturers, and suppliers, success in this era will depend less on cost arbitrage alone and more on strategic resilience, flexibility, proactive adaptation, and navigating policy headwinds.

Empty Cart

Empty Cart